Table of Contents

ToggleWhen it comes to buying a home, choosing the right mortgage can feel like navigating a maze blindfolded. Enter the FHA and conventional mortgage rates, two contenders in the ring that could make or break your homeownership dreams. One promises lower down payments and more flexibility, while the other boasts competitive rates and less red tape. It’s like choosing between a cozy sweater and a sleek jacket—both have their perks, but which one fits your lifestyle?

Overview of FHA and Conventional Mortgages

FHA loans are government-backed mortgage options designed to assist first-time homebuyers and those with lower credit scores. They typically require a lower down payment, often as low as 3.5 percent of the home’s purchase price. Applicants who qualify for these loans may benefit from less stringent credit requirements, making homeownership more accessible.

Conventional loans, on the other hand, aren’t backed by any government agency. These loans usually feature competitive interest rates and can require a down payment of 5 to 20 percent. Borrowers with good credit often favor conventional loans due to their flexibility and potential for lower overall costs.

FHA financing includes mortgage insurance that protects lenders in case of default, which adds an extra cost to borrowers. Conventional loans may also require mortgage insurance if the down payment is less than 20 percent, but this cost can be eliminated once the borrower builds equity in the home.

Both FHA and conventional loans offer unique advantages depending on a borrower’s financial situation. FHA loans excel in accommodating low-to-moderate income buyers and those with limited savings. Conversely, conventional loans appeal to individuals with higher credit scores seeking greater financing options.

Each option plays a vital role in the mortgage landscape, and understanding their differences aids in making informed decisions. Analyzing both types can reveal which mortgage type aligns better with individual needs and circumstances.

Key Differences Between FHA and Conventional Mortgages

Understanding the key differences between FHA and conventional mortgages helps borrowers choose the right option for their financial situations. The distinctions primarily revolve around down payment requirements, credit score criteria, and mortgage insurance costs.

Down Payment Requirements

FHA loans require a minimum down payment of 3.5 percent for eligible borrowers. This benefit caters to first-time homebuyers or those with limited savings. In contrast, conventional loans typically require down payments ranging from 5 to 20 percent. Higher down payments can result in better interest rates for conventional financing, making it appealing for buyers with significant upfront savings.

Credit Score Requirements

FHA loans generally accept lower credit scores, often allowing scores as low as 580. This flexibility encourages homeownership among those with less-than-perfect credit histories. Conventional loans, however, demand higher credit scores, commonly requiring a minimum score of 620. Borrowers with good credit may benefit from competitive interest rates when choosing conventional options.

Mortgage Insurance

Mortgage insurance is a key factor in determining overall loan costs. FHA loans mandatorily include mortgage insurance premiums, which add to the monthly payment throughout the loan term. Conventional loans may require mortgage insurance when the down payment is below 20 percent, yet it can be canceled once sufficient equity is established. This potential for removal serves as an incentive for conventional loan borrowers to build equity quickly.

Analyzing FHA vs Conventional Mortgage Rates

Understanding the current state of FHA and conventional mortgage rates helps borrowers make informed choices.

Current Rate Trends

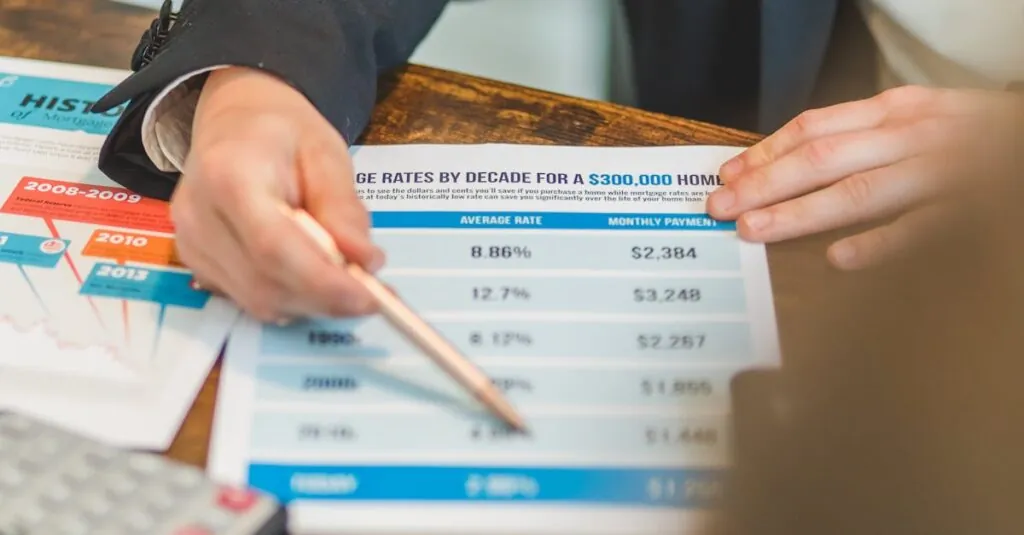

FHA mortgage rates generally remain lower than conventional rates, attracting first-time buyers and those with lower credit scores. Current trends show FHA rates averaging around 3.25 percent, while conventional mortgage rates hover closer to 3.75 percent. These variances often depend on the borrower’s credit profile and market conditions. It’s important to monitor changes regularly, as they can impact overall affordability and monthly payments. A borrower should regularly check rate updates from reliable sources to gauge the best time for a mortgage application.

Factors Influencing Rates

Several factors significantly influence FHA and conventional mortgage rates. Credit score plays a critical role, with higher scores often securing lower rates. Additionally, loan-to-value ratios affect rates; lower ratios typically result in better terms. Market conditions, such as inflation and economic stability, can also sway interest rates. Lenders assess these elements when determining the rates they offer to borrowers. Understanding these factors brings a clearer picture of why rates vary and what borrowers might expect based on their financial situations.

Pros and Cons of FHA and Conventional Mortgages

Both FHA and conventional mortgages present unique benefits and drawbacks, making it essential for borrowers to weigh their options carefully.

Advantages of FHA Mortgages

FHA mortgages shine in accessibility, appealing to first-time homebuyers and those with lower credit scores. With down payments starting as low as 3.5 percent, these loans make homeownership attainable. Less stringent credit requirements, often accepting scores as low as 580, lower the barriers to entry. Additionally, FHA loans provide flexibility in debt-to-income ratios, allowing for greater loan amounts relative to a borrower’s income. This combination of features makes FHA loans a strong option for low-to-moderate income individuals seeking to enter the housing market.

Advantages of Conventional Mortgages

Conventional mortgages attract borrowers with competitive interest rates and fewer restrictions. Down payments typically range from 5 to 20 percent, offering flexibility for those who can afford a larger upfront cost. Borrowers with good credit can benefit from the lower rates available, enhancing long-term affordability. Once the borrower builds 20 percent equity, mortgage insurance requirements can often be removed, reducing monthly payments significantly. These characteristics make conventional loans appealing for those who seek flexibility and potentially lower costs over time.

Choosing between FHA and conventional mortgage rates depends on individual financial circumstances and homeownership goals. FHA loans provide an accessible path for first-time buyers and those with lower credit scores, while conventional loans offer competitive rates for those with stronger credit profiles.

The decision ultimately hinges on factors like down payment capability and long-term financial plans. By carefully considering the unique advantages of each option and staying informed about current market trends, borrowers can make choices that best suit their needs. Understanding these nuances can lead to a more confident and informed home buying experience.